Though still at a nascent stage in India, disclosures related to ESG are soon becoming a norm, with stakeholders and regulatory bodies demanding better reporting of non-financial performance from organisations. Addressing the need to extend and enhance the ESG disclosures in India, the Securities and Exchange Board of India (SEBI) launched the new Business Responsibility and Sustainability Reporting (BRSR) framework in May 2021 to replace the existing Business Responsibility Reporting (BRR) framework.

What is BRSR?

Though still at a nascent stage in India, disclosures related to ESG are soon becoming a norm, with stakeholders and regulatory bodies demanding better reporting of non-financial performance from organisations. Addressing the need to extend and enhance the ESG disclosures in India, the Securities and Exchange Board of India (SEBI) launched the new Business Responsibility and Sustainability Reporting (BRSR) framework in May 2021 to replace the existing Business Responsibility Reporting (BRR) framework.

'BRSR is a standard and consistent framework which has been prepared keeping in mind the dynamic global trends in sustainability reporting. It is evident that the Indian reporting scenario is evolving rapidly in line with international norms and regulations where corporates are expected to run businesses conscientiously and maintain transparency and accountability in reporting. BRSR is expected to be used as a single source for disclosing sustainability-related information in India. It would also serve as a base document for various stakeholders, especially investors, to bring about comparability amongst companies.''

– Business Responsibility and Sustainability Report: An attempt to mainstream ESG, July 2021 by PwC

Who must follow the new framework?

- The new BRSR framework is mandatory from FY2023 for the top 1,000 listed companies by market capitalisation. For FY2022, it is voluntary for them.

- Listed companies other than the top 1,000 may voluntarily submit a BRSR report FY2022 onwards.

Indian reporting landscape’s journey to BRSR

In 2009, the Ministry of Corporate Affairs (MCA) issued the Voluntary Guidelines on Corporate Social Responsibility as the first step towards making business responsibility a mandate for corporates. Thus began the journey of ESG reporting in India.

Since then, business responsibility reporting had evolved significantly.

2009

The MCA issued National Voluntary Guidelines (NVGs) on corporate social responsibility

2012

SEBI made it compulsory for the top 100 listed companies by market capitalisation to file BRR based on NVGs, along with their annual reports

2014

Corporate Social Responsibility (CSR) becomes mandatory and CSR rules come into force

2015

Filing BRR was extended to the top 500 companies by market capitalisation

2017

Filing BRR was extended to the top 500 companies by market capitalisation

2019

National Guidelines of Responsible Business Conduct (NGRBC) is released

2021

SEBI introduced BRSR in May

Source: MCA, SEBI, Companies Act, 2013

What is the difference between BRR and BRSR?

The Indian Institute of Corporate Affairs (IICA) developed the BRSR based on a study conducted in collaboration with the United Nations Children’s Fund (UNICEF) in 2018 (IICA-UNICEF study). The study exposed the gaps in the SEBI-BRR framework – the information provided by the companies was not absolutely clear and/or accurate. Thus, the BRSR was formulated to improve upon the BRR and make businesses report their non-financial performance with enhanced transparency.

The nomenclature was changed from Business Responsibility Reporting (BRR) to Business Responsibility and Sustainability reporting (BRSR) to convey the focus on sustainability and business responsibility.

The following notable differences can be observed:

|

BRR |

BRSR |

|---|---|

|

Applicable to the top 1,000 listed companies by market capitalisation |

Applicable to the top 1,000 listed companies by market capitalisation from FY2023 Expected to be applicable to all listed and unlisted companies in the near future |

|

Disclosures to be made in annual report |

Disclosures to be made in annual report and 1 MCA21 portal through 2 XBRL language |

|

Only quantitative disclosures |

Both quantitative and qualitative disclosures |

|

One universal template |

Two formats:

|

MCA21 is an e-governance initiative of the Ministry of Company Affairs (MCA), Government of India. It enables easy and secure access of the MCA services to corporates, professionals and Indian citizens.

XBRL, short for extensible business reporting language), is an XM-based computer software language developed for the automation of business information requirements such as the preparation, sharing and analysis of financial reports, statements and audit schedules. Read more here.

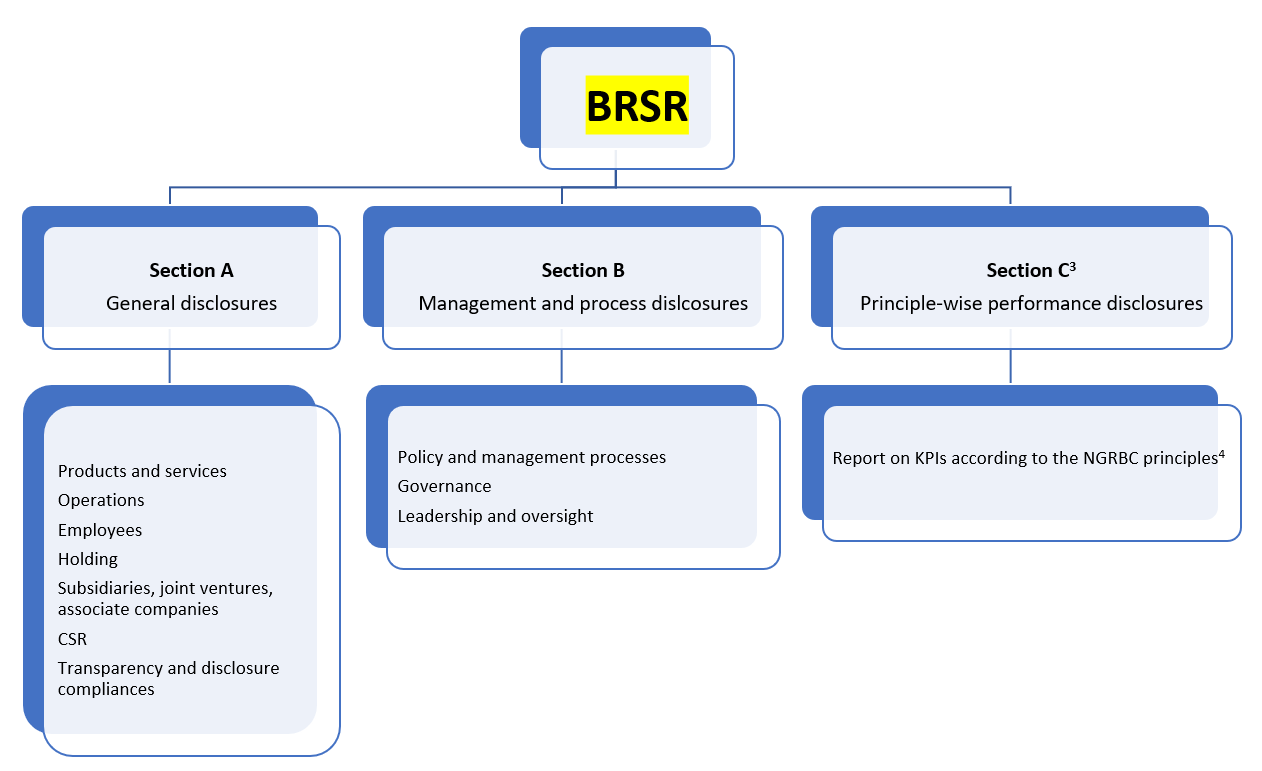

The new BRSR structure

Source: SEBI circular dated May 10, 2021

Two types of KPIs

In Section C, KPIs are classified into two categories:

-

Essential indicators: These are mandatory for reporting companies and include information on:

- Training programmes conducted

- Environmental data on energy, waste, water and emissions

- Social impact made by the company

-

Leadership indicators: These are voluntary and reflect better accountability and

purpose. The KPIS could include information on:

- Lifecycle assessments

- Conflict management policy

- Biodiversity

- Energy consumption

- Scope 3 emissions

- Supply chain disclosures

The nine principles of NGRBC

- Businesses should conduct and govern themselves with integrity in a manner that is ethical, transparent and accountable.

- Businesses should provide goods and services in a manner that is sustainable and safe.

- Businesses should respect and promote the well-being of all employees, including those in their value chains.

- Businesses should respect the interests of and be responsive to all their stakeholders.

- Businesses should respect and promote human rights.

- Businesses should respect and make efforts to protect and restore the environment.

- Businesses, when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent.

- Businesses should promote inclusive growth and equitable development.

- Businesses should engage with and provide value to their consumers in a responsible manner.

Compared to BRR, BRSR is more comprehensive, and will prove to be an effective communication tool for disclosing an organisation’s non-financial performance. With the help of BRSR, rating agencies and assurance providers will be able to do their job better. It is also expected to further improve the ESG reporting landscape in India, while providing consistency.

Sources:

Previous post

Previous post